CapitalGP Global Equity Strategy

This actively managed fund invests in a diversified portfolio of global stocks, with the goal of outperforming the stock market without taking on more risk. Currency risk is managed independently of stock risk.

Risk Measures

(1999 - 2023)

Risk Management

How We Approach Risk Management.

We believe that the only real risk to investors is the permanent loss of capital. Short-term fluctuations in the market or underperformance relative to a benchmark are not real risks.

We invest in companies that we believe are significantly undervalued. This means that we are buying assets for less than their true worth, which gives us a margin of safety and reduces our risk of loss.

We do not have any strict limits on our funds' regional or sector exposures. Instead, we take a flexible approach and invest in the best opportunities we find, regardless of where they are located or what industry they operate in.

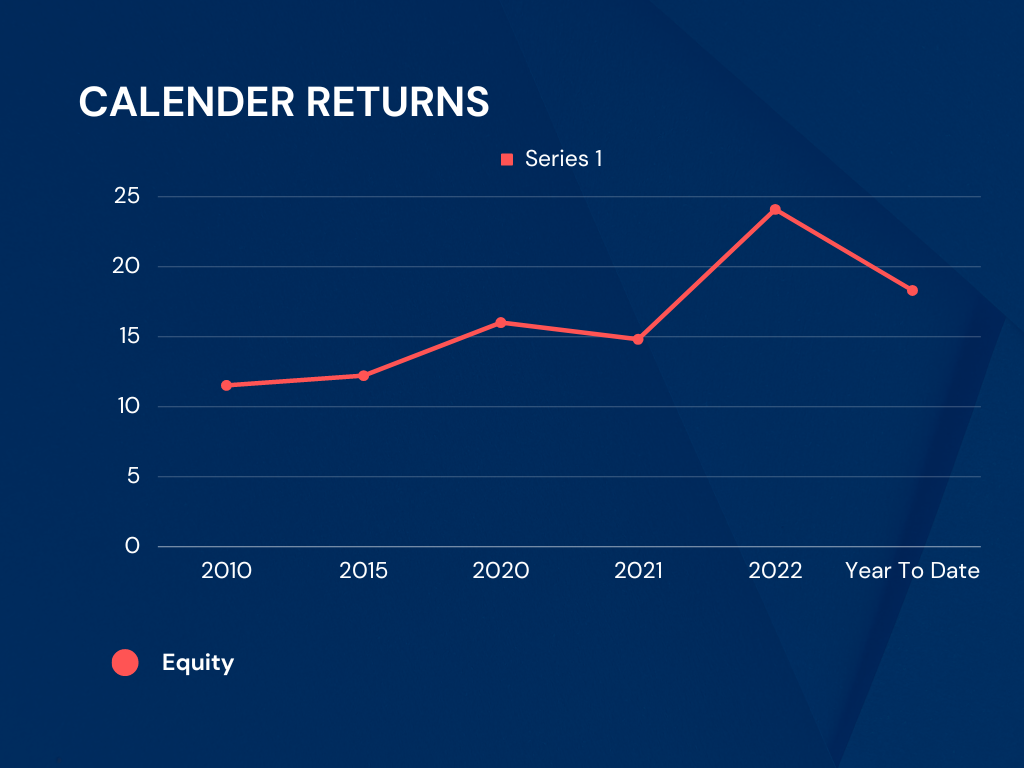

Returns

Variation in Returns and Drawdown.

Our funds aim to generate higher returns than the benchmark, but we take a highly active approach to investing, which means that our short-term performance may fluctuate. However, we believe that this risk is worth taking because we are focused on achieving long-term returns.

Our funds have outperformed the benchmark in down markets because we invest in individual companies that are trading at attractive valuations. This means that our funds have experienced smaller losses and recovered faster than the benchmark after market downturns.

| CAPITALGP Equity Strategy | MCSI World Index* | |

|---|---|---|

| Absolute Risk Measures | ||

| Max Drawdown % | 45 | 54 |

| Months to recovery | 30 | 69 |

| % of months spent in drawdowns of: | ||

| >5% | 30% | 52% |

| >10% | 15% | 36% |

| >20% | 2% | 20% |

| Annual monthly variations % | 18 | 15.2 |

| Relative Risk Measures | ||

| Beta | 0.8 | 1.0 |

| Tracking error % | 9.1 | 0.0 |

| Market movement capture | ||

| Upside capture % | 115 | 100 |

| Downside capture % | 89 | 100 |

Risk measures are calculated after the fact and are based on monthly returns. Months to recovery measures how long it takes for a fund to recover from a loss. Percentage of months in drawdown calculates how often a fund's price is below its previous peak. Downside and upside capture measure how well a fund performs relative to a benchmark in down and up markets, respectively.

Past performance is not a guarantee of future results. The value of CapitalGP Funds' shares can go down as well as up and you may not get back the full amount you invest. When investing in the Funds, your capital is at risk.

Returns are calculated before all taxes and fees, and assume that dividends are reinvested. Net returns for CapitalGP Funds are calculated after all fees and expenses, and assume that dividends are reinvested.

CapitalGP Core RRF class or series returns are based on a hypothetical investment of US$20 million at the inception of the Strategy, with no subsequent transactions. The returns of an actual investor may vary depending on when and how much they invest.

Where we have expressed performance in a currency other than the nominated currency for the relevant CapitalGP Strategy or comparator, as applicable, we have used prevailing exchange rates at the close of business on the relevant date. These amounts and returns are for informational purposes only and may differ from the level at which a transaction could have been executed in the relevant market.

Strategy gross returns are a weighted average of the actual gross returns of all the funds that follow the same investment objective. Strategy net returns are based on the specified fee structure applied to the Strategy gross returns and do not represent actual net returns experienced by investors in the relevant CapitalGP Funds.

*Net of withholding taxes means that taxes have been taken out of the returns.